Author Archives: Howard

You Need a Plan

- December 6, 2015,

- Leave a comment,

- Author: Howard

- Categories: Low Income

Even you’re scraping by on a minimum-wage job, you need a budget. The basic plan is pretty straightforward: Total your income from all sources Estimate you total expenses Calculate the difference If the difference is negative, you need to figure out how to fix that! You can either increase your income, or decrease the outgo, or both. The easiest way is usually to decrease your outgo. If you have been caught up in the credit card trap, the first step […]

Want to Cruise? Avoid These Money Traps!

- March 28, 2015,

- Leave a comment,

- Author: Howard

- Categories: Bargains

Cruising can be one of the most economical modes of vacationing, considering what you get for your cruise fee, namely, a floating luxury hotel that travels to several ports. All of the meals are included (well, sort of… see below), and you only have to unpack and re-pack once. Many of the amenities are no extra charge. Cruising has been one of the favorite activities that my wife and I have done for the last several years. My wife likes it […]

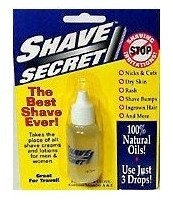

Shaving on the Cheap

- April 19, 2014,

- Leave a comment,

- Author: Howard

- Categories: Bargains

I keep running across various ways to save “lots” of money on the ritual of shaving. That sort of post seems to have a very broad appeal, since almost everybody shaves. Most women shave their legs, and most men shave their faces. I wear a beard, but I still shave in order to keep the appearance neat. A few months ago, I saw a blog post on Thousandaire about reducing the cost of shaving your face to a couple of […]

New Theme

- March 6, 2014,

- Leave a comment,

- Author: Howard

- Categories: Blogging

When Mrs. BFTROU set up this blog, she chose the Atahualpa theme, mainly to experiment with it. One of our friends uses Atahualpa, so we figured it would be a good theme to use. Today, I got rid of it.

A Credit Report That is Really Free!

- March 1, 2014,

- Leave a comment,

- Author: Howard

- Categories: Bargains, Savings, Services

Usually, when you get a “free” credit report, you have to enter a credit card. Then, if you forget to cancel your “service” you get billed after the “free” month. However, there is a credit reporting service that doesn’t do that. It is really free. They are hoping that you like the service enough to continue to use it – and they appear to have lots of happy “customers.” One minor glitch, however — it isn’t really your “offical” FICO […]

Valentine’s Day!

- February 8, 2014,

- Leave a comment,

- Author: Howard

- Categories: Bargains

It’s interesting how caught up we get in holiday spending. Valentine’s Day is a prime example. It’s a purely arbitrary date, but a huge percentage of the population has been caught up in the idea that if you don’t get your significant other something nice for Valentine’s Day, you are just a jerk. Worse yet, it absolutely must be presented on February 14th, and it can’t be anything practical, or you can end up in the doghouse, as depicted in […]

January is the Time to Buy…

- December 30, 2013,

- Leave a comment,

- Author: Howard

- Categories: Bargains, Discount Programs

…almost anything at Amazon. Yeah, there are always lots of Amazon ads. And there are sales and rumors of sales. So how is January different for Amazon? Here’s how: On February 15th, FBA (Fulfilled by Amazon) sellers will be billed for something called “long-term storage.” The FBA sellers will get the warning email in mid-January — and a lot of them will panic. Some FBA sellers with very large inventories will see long-term storage fees, which are based on volume, […]

August – The Time (not) to Buy…

- August 10, 2013,

- Leave a comment,

- Author: Howard

- Categories: Bargains, Taxes

In August, there are usually lots of sales on things like school supplies, and it doesn’t take much shopping around to find good deals in that area. Also, in some states (like here in Texas), there are sometimes “tax holidays” for school supplies, which sometimes extends to other items such as children’s clothing. Depending on the sales tax rate, this can be a substantial incentive to buy these items. However, there are several things that are typically a better bargain […]

When a Bargain is NOT a Bargain

- March 6, 2013,

- Leave a comment,

- Author: Howard

- Categories: Bargains

Sometimes, spending a bit more money on something you use on a regular basis can be better than trying to get the absolute lowest price. For instance, if I had just bought a middle-of-the-line professional camera to start off with, instead of getting a really cheap compact point and shoot that I threw away, then a low-end compact point-and-shoot (which was a little shy on resolution, although it worked ok for my purposes at the time as long as I […]

Ebates — Get Money Back on Online Purchases!

-

Recent Posts

All My Websites

Blogs I Like